Key Points

- Bond market tumble may be terminal

- Sea change in activity underway

- Non-OECD is leading everything now

- Bifurcation Revolution underway

- All resources commodities looking very strong

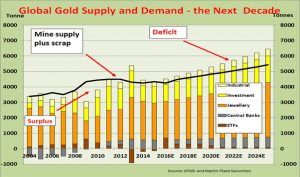

- Gold outlook improving rapidly

The probable peaking of the global bond market bubble over the past month or so could be an indication again that the `Bifurcation' strategy is now in full swing and that the outlook for commodities, equities and technologies is now improving rapidly.

'Bubbles' are those occurrences and mania when everyone is so engrossed with fine detail that no one is focusing on the bigger picture and doesn't notice that a bubble even existed. Bubbles are usually reserved for the fringe players in the fringe markets where cowboys are rife and the gullible public is sucked in. Something like gold or mining stocks. China stock market or property. Japanese stock market. Tulips or something in the South Seas. But never in the conservative markets like government bonds! No, never! Yeah, right.

Sentiment in the bond markets has clearly been somewhat euphoric such that investors have actually paid governments to hold their money.

So the world's biggest non-currency market with all its US$100trillion or so (with about US$19.4tn from the US Federal Government) has been in a bubble.

In my experience this is a bubble and one like no other.

Firstly, there seems to been an almost universal acceptance of the infallibility of central banks, bureaucrats and bankers and then there is an economist and media focus on the minutiae of the next rate cut or hike. As noted previously, one paragraph from the US Fed and 10,000 different interpretations.

Look also at the role of super bureaucrats in the unelected European Commission.

This is a link to a Wall Street Journal article on the Apple US$14.5bn tax. http://www.wsj.com/articles/europes-apple-tax-ambush-1472599362

This is exactly why we will have our `bifurcation'.

Secondly, current US interest rate policy is not about 'tighter' or 'easier' money. It is about the price of money from the Fed. It does not currently affect the availability of money nor the stock of currency but maybe it may affect the flow of money. The US QE went to the banks to repair their balance sheets. The banks kept the money. Now with rates rising, the pressure is on the banks to lend it out. The conclusion must be that the US economy is and will be quite strong.

But now some matters are falling into place that will now affect the flow of money as capital.

The matter of the quality of the issuer. Who is actually issuing and standing behind government bonds in Euro currency? Are investors likely to be enthralled by either of the front runners in the US Presidential elections? Japan, with almost 300% GDP as debt? Australia, with the pettiness of the current very poor crop of Federal politicians?

If weak economies need short term government welfare and other programmes that generate very modest IRRs and save citizens from loss of self-esteem then those `short term' actions may be workable with ultralow interest rates. But low IRR programmes won't work if rates are higher.

Social welfare costs are rising dangerously all around the world now and as politicians are in on the game it is up to the markets to force the changes. And the best way is for people to get jobs or start businesses have better lives. The coming Global Boom will do all of that. People are making money in the share markets again and property prices are holding up very well.

Everyone should be aware of the concept of the economic multiplier and how social welfare transfer payments have a multiplier of less than one after bureaucracy costs.

In contrast, infrastructure expenditures often have very high economic multipliers that reach double digits.

The world's debt mountain is there and still growing. The cash mountain is still rising too and offsets much of this. In Australia the cash mountain is still growing but the rate of change is heading lower so the capital flow action away from fear is actually now underway.

Australia's huge cash mountain that needs to be put to work.

Keep in mind that now it has begun the turning process it will be flowing into shares and property for MANY years to come.

The key to the fear market is the rush to cash and bonds for income.

The bubble that encapsulates the bond markets and talk of negative yields is now about to burst.

This graphic clearly highlights the deterioration in the price of the key US 10 year T-Bond.

The price on the 10 year bond is the same as in the nadir of the GFC and the peak in this US T bond market came back in mid 2012.

This graphic appears very bearish to me since each 'good bye kiss' on the lower uptrend line confirms internal market weakness. A sharp move down is really possible and would signal much lower prices and rising bond yields.

The 30 Year has made its high in 2016 but is massively overbought and yes that is a rising narrowing wedge that is usually resolved with a sharp break in the opposite direction.

These two markets had important spike lows in yields in the past two months and are signalling that all rates are likely to be heading higher now.

And the US Treasury thinks that the US Deficit will bottom in FY18 and head higher again. More bonds to sell.

Surprisingly, the US Treasury has only about 30% of its bond portfolio with maturities more than 5 years. It would have seemed logical to get as much long term money at these low rates as possible.

The Euphoria in the bubble gave us the negative interest rate baloney and these are the nearest actions to market 'reversals' one could ever imagine.

UK yields are heading higher.

Germany is certainly bottoming too.

And Japan. Still negative but rising.

Now this is not a doomsday note, far from it, because most of the debt will be rolled over but analysis of the take up of US borrowing does show that domestic Investors have been the largest buyers in this euphoric bubble.

But we are most interested in the flow out of bonds into gold, commodities and equities.

And this is just a wonderful single graph pointing it all out.

Gold is leading.

Australian Gold Stocks have been the key market leaders.

All the rest will follow.

In my view the real economy in the US seems to be doing well with employment, motor vehicle sales and housing. The evidence is strong.

I continue to like this pair of graphics. Housing starts at the highest levels since 2007 but still well below the long term level of 1.5m units pa. The area under the curve is inventory catch up of about 6 million dwellings. Note that the companies in the sector are also doing very well.

These alone suggest interest rates are too low and should be heading higher.

Copper vs 30 Year T Bonds might also be telling us that the deflationary forces are ending and recovery is underway.

All the LME metals have had a good 2016 with zinc and tin being the stars. Expect a lot more to come.

And LME inventories for Copper Lead Zinc Tin are at new lows on the MPS model.

Even more impressive though is the decline in Aluminium LME inventories from 5.4mt (12% of annual consumption – 6 weeks supply) in early 2014 to 2.1mt (just 3.6% now -

The ASX Metals and Minerals has made an important downtrend break.

And you may have noticed coking coal prices hit US$200/t last week.

Source: Metal Bulletin

Source: Metal Bulletin

Quite an impressive performance. Up 144% in under 6 months. Many other commodities will be doing this soon too.

I hope you are feeling the Boom coming through.

The world has changed radically over the past decade as the emerging countries of Asia and their 3,300m people accelerate their wealth generation and living standards.

Here we can see the aggregates in terms of energy consumption and also from steel consumption as Non-OECD (mostly China, India and ASEAN) rapidly overtakes the OECD countries. Make sure you are not looking at the world through the rear vision mirror.

|

|

The strong growth from China in basic raw materials of steel and energy have totally distorted the historic global consumption graph so that for the resources sector what happens in China is far more important than what is occurring in Europe or even Japan. As Non-OECD (essentially China) is well over 55% (try 60%) by definition and strong growth here increases the overall average growth rate in demand. Global demand is now accelerating! Keep this in mind if you are in the supply of tonnes business.

So coming back to China we have the world's behemoth of steel actually hitting new all time highs in the production of crude steel in June (845mtpa) but more importantly the 12 month moving average of rate of change for crude steel production actually turned positive again.

|

|

Note steel can be used as a proxy for all metals.

So this is not a bearish development.

Concerns have been raised about the level of steel output in China on a per capita basis but as this Wood McKenzie data (courtesy of Fortescue and concept highlighted in 2014 by Dawes Points) shows, the 4 billion tonnes of steel production in China since 2000 has still left the capital stock of steel well below the US, let alone the highly steel intensive nearby countries like Japan and Sth Korea.

Wood McKenzie also kindly has shown (again courtesy of Fortescue) a graphic showing the different regional growth rates in China.

The rolling recession in 1982 in the US provided a wonderful example of a significant and very diverse economic unit. Misery in the Oil Patch and the Rust Belts of the day were offset by the Florida grey immigration and booming SW. Silicon Valley was emerging as well. Transitions and transpositions.

The Recession of 1982, the worst there since the 1930s, led to the biggest US equity bull market ever. Is this what is happening again now, globally?

Technology is leading.

There is much more to say about technology in so many areas and do watch closely Virtual Reality and Augmented Reality. More coming in Part 2.

And this graphic speaks volumes for India if you haven't seen it before.

I still like gold very much and consider that after almost 10 weeks of correction gold and gold stocks are about to move ahead strongly

You might like to note some of my recent interviews on gold

Kitco

Alan Kohler

CNBC

I hope you are on board.

Barry Dawes

BSc F AusIMM MSAA

Australia's huge cash mountain that needs to be put to work.

Keep in mind that now it has begun the turning process it will be flowing into shares and property for MANY years to come.

The key to the fear market is the rush to cash and bonds for income.

The bubble that encapsulates the bond markets and talk of negative yields is now about to burst.

This graphic clearly highlights the deterioration in the price of the key US 10 year T-Bond.

The price on the 10 year bond is the same as in the nadir of the GFC and the peak in this US T bond market came back in mid 2012.

This graphic appears very bearish to me since each 'good bye kiss' on the lower uptrend line confirms internal market weakness. A sharp move down is really possible and would signal much lower prices and rising bond yields.

Australia's huge cash mountain that needs to be put to work.

Keep in mind that now it has begun the turning process it will be flowing into shares and property for MANY years to come.

The key to the fear market is the rush to cash and bonds for income.

The bubble that encapsulates the bond markets and talk of negative yields is now about to burst.

This graphic clearly highlights the deterioration in the price of the key US 10 year T-Bond.

The price on the 10 year bond is the same as in the nadir of the GFC and the peak in this US T bond market came back in mid 2012.

This graphic appears very bearish to me since each 'good bye kiss' on the lower uptrend line confirms internal market weakness. A sharp move down is really possible and would signal much lower prices and rising bond yields.

The 30 Year has made its high in 2016 but is massively overbought and yes that is a rising narrowing wedge that is usually resolved with a sharp break in the opposite direction.

The 30 Year has made its high in 2016 but is massively overbought and yes that is a rising narrowing wedge that is usually resolved with a sharp break in the opposite direction.

These two markets had important spike lows in yields in the past two months and are signalling that all rates are likely to be heading higher now.

And the US Treasury thinks that the US Deficit will bottom in FY18 and head higher again. More bonds to sell.

These two markets had important spike lows in yields in the past two months and are signalling that all rates are likely to be heading higher now.

And the US Treasury thinks that the US Deficit will bottom in FY18 and head higher again. More bonds to sell.

Surprisingly, the US Treasury has only about 30% of its bond portfolio with maturities more than 5 years. It would have seemed logical to get as much long term money at these low rates as possible.

The Euphoria in the bubble gave us the negative interest rate baloney and these are the nearest actions to market 'reversals' one could ever imagine.

UK yields are heading higher.

Surprisingly, the US Treasury has only about 30% of its bond portfolio with maturities more than 5 years. It would have seemed logical to get as much long term money at these low rates as possible.

The Euphoria in the bubble gave us the negative interest rate baloney and these are the nearest actions to market 'reversals' one could ever imagine.

UK yields are heading higher.

Germany is certainly bottoming too.

Germany is certainly bottoming too.

And Japan. Still negative but rising.

And Japan. Still negative but rising.

Now this is not a doomsday note, far from it, because most of the debt will be rolled over but analysis of the take up of US borrowing does show that domestic Investors have been the largest buyers in this euphoric bubble.

But we are most interested in the flow out of bonds into gold, commodities and equities.

And this is just a wonderful single graph pointing it all out.

Now this is not a doomsday note, far from it, because most of the debt will be rolled over but analysis of the take up of US borrowing does show that domestic Investors have been the largest buyers in this euphoric bubble.

But we are most interested in the flow out of bonds into gold, commodities and equities.

And this is just a wonderful single graph pointing it all out.

Gold is leading.

Australian Gold Stocks have been the key market leaders.

All the rest will follow.

In my view the real economy in the US seems to be doing well with employment, motor vehicle sales and housing. The evidence is strong.

I continue to like this pair of graphics. Housing starts at the highest levels since 2007 but still well below the long term level of 1.5m units pa. The area under the curve is inventory catch up of about 6 million dwellings. Note that the companies in the sector are also doing very well.

Gold is leading.

Australian Gold Stocks have been the key market leaders.

All the rest will follow.

In my view the real economy in the US seems to be doing well with employment, motor vehicle sales and housing. The evidence is strong.

I continue to like this pair of graphics. Housing starts at the highest levels since 2007 but still well below the long term level of 1.5m units pa. The area under the curve is inventory catch up of about 6 million dwellings. Note that the companies in the sector are also doing very well.

These alone suggest interest rates are too low and should be heading higher.

Copper vs 30 Year T Bonds might also be telling us that the deflationary forces are ending and recovery is underway.

These alone suggest interest rates are too low and should be heading higher.

Copper vs 30 Year T Bonds might also be telling us that the deflationary forces are ending and recovery is underway.

All the LME metals have had a good 2016 with zinc and tin being the stars. Expect a lot more to come.

All the LME metals have had a good 2016 with zinc and tin being the stars. Expect a lot more to come.

And LME inventories for Copper Lead Zinc Tin are at new lows on the MPS model.

And LME inventories for Copper Lead Zinc Tin are at new lows on the MPS model.

Even more impressive though is the decline in Aluminium LME inventories from 5.4mt (12% of annual consumption – 6 weeks supply) in early 2014 to 2.1mt (just 3.6% now -

The ASX Metals and Minerals has made an important downtrend break.

Even more impressive though is the decline in Aluminium LME inventories from 5.4mt (12% of annual consumption – 6 weeks supply) in early 2014 to 2.1mt (just 3.6% now -

The ASX Metals and Minerals has made an important downtrend break.

And you may have noticed coking coal prices hit US$200/t last week.

And you may have noticed coking coal prices hit US$200/t last week.

Source: Metal Bulletin

Quite an impressive performance. Up 144% in under 6 months. Many other commodities will be doing this soon too.

I hope you are feeling the Boom coming through.

The world has changed radically over the past decade as the emerging countries of Asia and their 3,300m people accelerate their wealth generation and living standards.

Here we can see the aggregates in terms of energy consumption and also from steel consumption as Non-OECD (mostly China, India and ASEAN) rapidly overtakes the OECD countries. Make sure you are not looking at the world through the rear vision mirror.

Source: Metal Bulletin

Quite an impressive performance. Up 144% in under 6 months. Many other commodities will be doing this soon too.

I hope you are feeling the Boom coming through.

The world has changed radically over the past decade as the emerging countries of Asia and their 3,300m people accelerate their wealth generation and living standards.

Here we can see the aggregates in terms of energy consumption and also from steel consumption as Non-OECD (mostly China, India and ASEAN) rapidly overtakes the OECD countries. Make sure you are not looking at the world through the rear vision mirror.

Wood McKenzie also kindly has shown (again courtesy of Fortescue) a graphic showing the different regional growth rates in China.

Wood McKenzie also kindly has shown (again courtesy of Fortescue) a graphic showing the different regional growth rates in China.

The rolling recession in 1982 in the US provided a wonderful example of a significant and very diverse economic unit. Misery in the Oil Patch and the Rust Belts of the day were offset by the Florida grey immigration and booming SW. Silicon Valley was emerging as well. Transitions and transpositions.

The Recession of 1982, the worst there since the 1930s, led to the biggest US equity bull market ever. Is this what is happening again now, globally?

Technology is leading.

The rolling recession in 1982 in the US provided a wonderful example of a significant and very diverse economic unit. Misery in the Oil Patch and the Rust Belts of the day were offset by the Florida grey immigration and booming SW. Silicon Valley was emerging as well. Transitions and transpositions.

The Recession of 1982, the worst there since the 1930s, led to the biggest US equity bull market ever. Is this what is happening again now, globally?

Technology is leading.

There is much more to say about technology in so many areas and do watch closely Virtual Reality and Augmented Reality. More coming in Part 2.

And this graphic speaks volumes for India if you haven't seen it before.

There is much more to say about technology in so many areas and do watch closely Virtual Reality and Augmented Reality. More coming in Part 2.

And this graphic speaks volumes for India if you haven't seen it before.

I still like gold very much and consider that after almost 10 weeks of correction gold and gold stocks are about to move ahead strongly

You might like to note some of my recent interviews on gold

Kitco

Alan Kohler

CNBC

I hope you are on board.

Barry Dawes

BSc F AusIMM MSAA

I still like gold very much and consider that after almost 10 weeks of correction gold and gold stocks are about to move ahead strongly

You might like to note some of my recent interviews on gold

Kitco

Alan Kohler

CNBC

I hope you are on board.

Barry Dawes

BSc F AusIMM MSAA

As the XGD approaches 6000 it is clear we are not now just picking up stocks that are cheap against the overall share market but they are still cheap against gold.

The relative performance of the XGD against the A$ gold price was shown last week and the peak in the XGD in April 2011 at 8499 was with A$1408/oz. The low in Nov 2014 was 80% lower at 1642 at an A$ gold price of A$1352 that was just 4% lower.

In the big North American market the gold stocks (the XAU) essentially underperformed US$ gold for two decades from 1996 despite the runup in gold from US$250 in 2000.

Should the longer term average of around 0.225 on this graphic be reattained then the XAU would still have a 200% rise against gold coming with the first stop still 50% higher than today.

As the XGD approaches 6000 it is clear we are not now just picking up stocks that are cheap against the overall share market but they are still cheap against gold.

The relative performance of the XGD against the A$ gold price was shown last week and the peak in the XGD in April 2011 at 8499 was with A$1408/oz. The low in Nov 2014 was 80% lower at 1642 at an A$ gold price of A$1352 that was just 4% lower.

In the big North American market the gold stocks (the XAU) essentially underperformed US$ gold for two decades from 1996 despite the runup in gold from US$250 in 2000.

Should the longer term average of around 0.225 on this graphic be reattained then the XAU would still have a 200% rise against gold coming with the first stop still 50% higher than today.

We all know the All Ords has struggled this year whilst the XGD is up 100% (the Dawes Points 2016 Portfolio is up 126%) but I still think it is early days yet so the outperformance should continue for quite some time.

In North America again gold stocks are up 150% against the SPX and this graphic suggests another 400% to come. Given that I am a bull on the US equity market it should mean gold and gold stocks will be looking very exciting. Again, for quite some time to come.

We all know the All Ords has struggled this year whilst the XGD is up 100% (the Dawes Points 2016 Portfolio is up 126%) but I still think it is early days yet so the outperformance should continue for quite some time.

In North America again gold stocks are up 150% against the SPX and this graphic suggests another 400% to come. Given that I am a bull on the US equity market it should mean gold and gold stocks will be looking very exciting. Again, for quite some time to come.

I think you will agree that the evidence in the gold sector is clear that something big is underway and clients have benefitted very well so far.

This same evidence is suggesting that the something big won't be limited to gold and silver but will extend into all resource sectors.

We can see it in the performance of metals like copper where technical support is at important levels and price is oversold. And demand is still robust and LME inventories are low.

What is there not to like?

I think you will agree that the evidence in the gold sector is clear that something big is underway and clients have benefitted very well so far.

This same evidence is suggesting that the something big won't be limited to gold and silver but will extend into all resource sectors.

We can see it in the performance of metals like copper where technical support is at important levels and price is oversold. And demand is still robust and LME inventories are low.

What is there not to like?

And whilst we are all intrigued and excited about the new truly disruptive technologies coming in energy generation and power storage that may really change the world and end the Age of Hydrocarbons the markets themselves are suggesting that it isn't quite time yet for that to occur.

The big oil stocks seem to indicate that oil prices have bottomed and will be heading higher in years to come.

I think its time to seriously consider adding selected hydrocarbon stocks to the portfolio.

And whilst we are all intrigued and excited about the new truly disruptive technologies coming in energy generation and power storage that may really change the world and end the Age of Hydrocarbons the markets themselves are suggesting that it isn't quite time yet for that to occur.

The big oil stocks seem to indicate that oil prices have bottomed and will be heading higher in years to come.

I think its time to seriously consider adding selected hydrocarbon stocks to the portfolio.

All this action is occurring in the gold sector while I have been taking a short break in ASEAN country.

Singapore was quite extraordinary in so many ways as passed on last week but I also made my first visit to Vietnam.

95 million people here and it seems like China on steroids. Ha Noi and Ha Long are showing massive construction and property development. Like China, developments have vast population drives to underpin them and provide rapid investment payback programmes that in Australia we could not fully comprehend.

ASEAN is 800m people together with rising living standards that for some countries are still well above China.

And ASEAN consumes 85mtpa of steel yet produces only 20mt.

And that little side show that caused all the fuss last week was quickly forgotten by the markets and the underlying forces are heading higher again.

I have not called the bond markets well but that doesn't mean the issues don't exist or have gone away. This still tells me that the risk reward in sovereign bonds is very unfavourable.

All this action is occurring in the gold sector while I have been taking a short break in ASEAN country.

Singapore was quite extraordinary in so many ways as passed on last week but I also made my first visit to Vietnam.

95 million people here and it seems like China on steroids. Ha Noi and Ha Long are showing massive construction and property development. Like China, developments have vast population drives to underpin them and provide rapid investment payback programmes that in Australia we could not fully comprehend.

ASEAN is 800m people together with rising living standards that for some countries are still well above China.

And ASEAN consumes 85mtpa of steel yet produces only 20mt.

And that little side show that caused all the fuss last week was quickly forgotten by the markets and the underlying forces are heading higher again.

I have not called the bond markets well but that doesn't mean the issues don't exist or have gone away. This still tells me that the risk reward in sovereign bonds is very unfavourable.

And when returns on low risk gold are so strong why bother taking those other risks in a market that is clearly rigged. Besides, when the problems start really start to emerge, the sellers of bonds will be buying gold and gold stocks!

Barry Dawes

And when returns on low risk gold are so strong why bother taking those other risks in a market that is clearly rigged. Besides, when the problems start really start to emerge, the sellers of bonds will be buying gold and gold stocks!

Barry Dawes